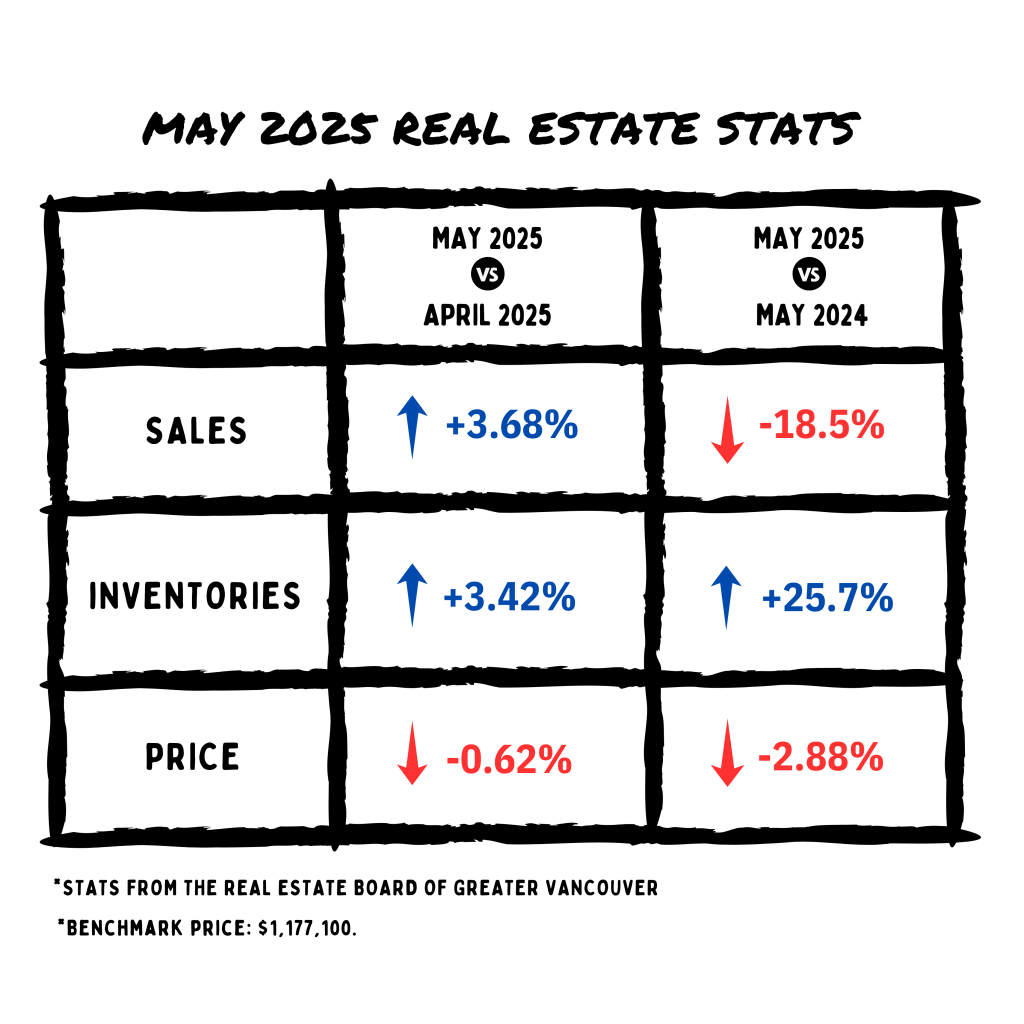

The real estate market remains uncertain and slow-moving. So far this year, home sales have been among the quietest in the past decade, similar to the slow starts in 2019 and 2020. While there are hints that activity may be turning a corner, May sales were still below the seasonal average.

At the same time, inventory keeps climbing. Listings in Metro Vancouver are up 25.7% compared to May 2024, and almost 46% above the 10-year average. Buyers have more options, but many are waiting on the sidelines, unsure of what comes next.

💰 What’s Happening in the Economy?

On June 4, the Bank of Canada held its policy interest rate at 2.75% for the second straight time. As a result, variable mortgage rates remain unchanged. This decision reflects a “wait and see” approach, as the Canadian economy shows signs of slowing, and global uncertainty—especially around possible U.S. tariffs—continues to cloud the outlook.

Inflation eased slightly in June, largely due to the removal of the carbon tax and lower oil prices. But these are temporary factors. The Bank is still focused on core inflation, which hasn’t cooled enough to justify rate cuts anytime soon.

- Fixed mortgage rates could still go up if bond yields rise.

- Variable rates are stable for now, but that could change depending on future inflation data.

📌 What This Means for Real Estate

The dip in inflation may offer some short-term relief for buyers, but the bigger picture is still unclear. With so many moving parts—interest rates, global politics, inflation risks—it’s hard to predict where the market is headed next. As we move into the second half of 2025, the market is still waiting for a clearer direction.