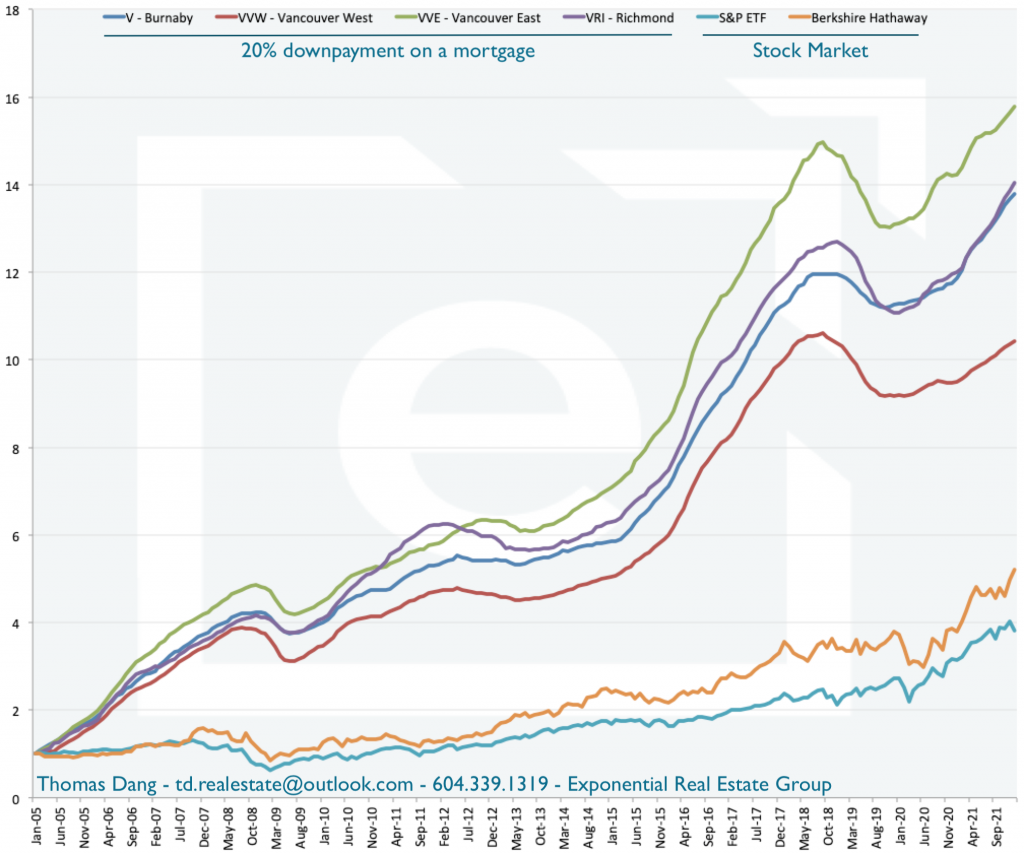

If you had a dollar to invest in anything, where would you put it? Supposed the options are putting your dollar into downpayment for a mortgage on a home in several different areas in Metro Vancouver, buying into an S&P Index Fund, or buying into Berkshire Hathaway, the investment company led by the legendary investor Warren Buffett.

If you invested that dollar in 2005 until 2022, what would you have now? Let’s have a look.

The orange line is Berkshire Hathaway. The Oracle of Omaha clearly outperformed the S&P Index (cyan), ie. the market at large. But no matter where you chose to make a downpayment on a home in Metro Vancouver, you would have outperformed a stock investment by a wide margin.

From time to time, you may have heard stories about that one friend in highschool who seemed average in every way, and fast forward 10-15 years later and they have several properties and a million plus in equity. You must be thinking, I have a very good job but I would never catch up to that! It’s easy to imagine that every success story by someone else must be via some questionable means, but if you live in an area as desireable as Metro Vancouver, the answer is likely a lot simpler: good decision making in real estate.

Why is real estate powerful?

It is the only method available to the common person to Leverage Safely.

Leveraging is multiplying the investment power of cash. If you put 1 dollar into a mortgage downpayment of 20%, then when your home price appreciates by 20%, your initial investment would have appreciated by 100%. If you plan to buy a home under 1M, you only need 10% minimum downpayment. This means that any appreciation on your home price will be magnified ten-fold compared to your initial cash.

Can you leverage in the stock market? You certainly can! This is called buying on Margin. However, with stock, if your position fall, your lender will require that you pay more cash into your account to maintain a minimum margin, or they will forced-sale your position. You would then take a loss, and because the cash in your account is now reduced, you are also no longer qualified to buy back the same position, even if you believe that it will recover.

A home, on the other hand, is legally protected. Even when your home price temporarily goes down, your mortgage is safe as long as you are still paying it down. That is because housing is tied to the livelihood of people. You cannot eat a stock, nor will it shelter you.

The fundamental things apply as time goes by.

That means, if you are not living in a home that you own and you are no longer living with your parents, chances are you are paying rent. Even as you plan to invest your saving elsewhere instead of real estate, you still need to set out some money to pay for housing each month.

How much rent? According to a 2021 report from the CMHC, a government agency, about 1800 a month for a 2 bedroom on average.

Let’s consider a 1M budget, which would buy a nice 2br condo in a central location or a 3br townhouse if you know where to look. You are putting in a 10% downpayment of 100K to take out a 900K mortgage at 3%, amortized over 25 years, standard payment terms. Every month, your mortgage payment would always be the same, but a part would go toward paying the principal, which is your money, and a part would go toward paying the interest. The interest is what you pay the bank for the benefit of being able to leverage 5 times, 10 times. Over time, the amount of interest you pay in each payment reduces until it reaches zero.

For this mortgage, the total interest you would pay over 25 years is 377,762. There are ways to reduce the total interest paid, but no need to go that far for this comparison to make sense. Let’s also add the strata (aka. maintenance) fee, 400/m is typical for 1000-1200sqft. Over 300 months (25 years), this work out to 120,000.

The total cost of ownership is then 497,762.

If you have been paying rent, over that same 25 years, you would be paying 1800 x 300 = 540,000, assuming that rent will stay the same for 25 years.

The difference is that in the first case, you own the home. You are entitled to any capital gain from the home, which you can use toward a bigger downpayment if you want to upgrade in the future. Some 3br townhomes may also be partially rentable.

But wait! Wait just a minute! I have heard everything you said here a hundred times, but I don’t want to be tied down to a place with a mortgage!

What if I want to leave Metro Vancouver for a new job? Or a different lifestyle?

Well, owning a home in such a desirable place like Metro Vancouver is certainly not an anchor that would tie you down. An average listing here doesn’t stay unsold for long, and I have the data to prove it. You may also be surprised to find that if you want to leave, selling may not even be the best option.

But I’m out of time for now, so until next time on this blog or Youtube, take care.

Thomas Dang

td.realestate@outlook.com – 604.339.1319

Exponential Real Estate Group – Jovi Realty Inc.