When you think of buying a home, it is always important to consider the location, convenience, and lifestyle that each property will facilitate, and your budget. But there’s always a nagging voice in the back of your head saying that the only proper real estate investment is a detached home! Might as well don’t buy at all if I have to settle for a condo apartment or townhome!

This folk wisdom that strata properties (condo and townhomes) are somehow “bad investments” sometimes prevent buyers from considering the many practical lifestyle benefits, such as typically better locations near skytrain and amenities, or a typically nicer view.

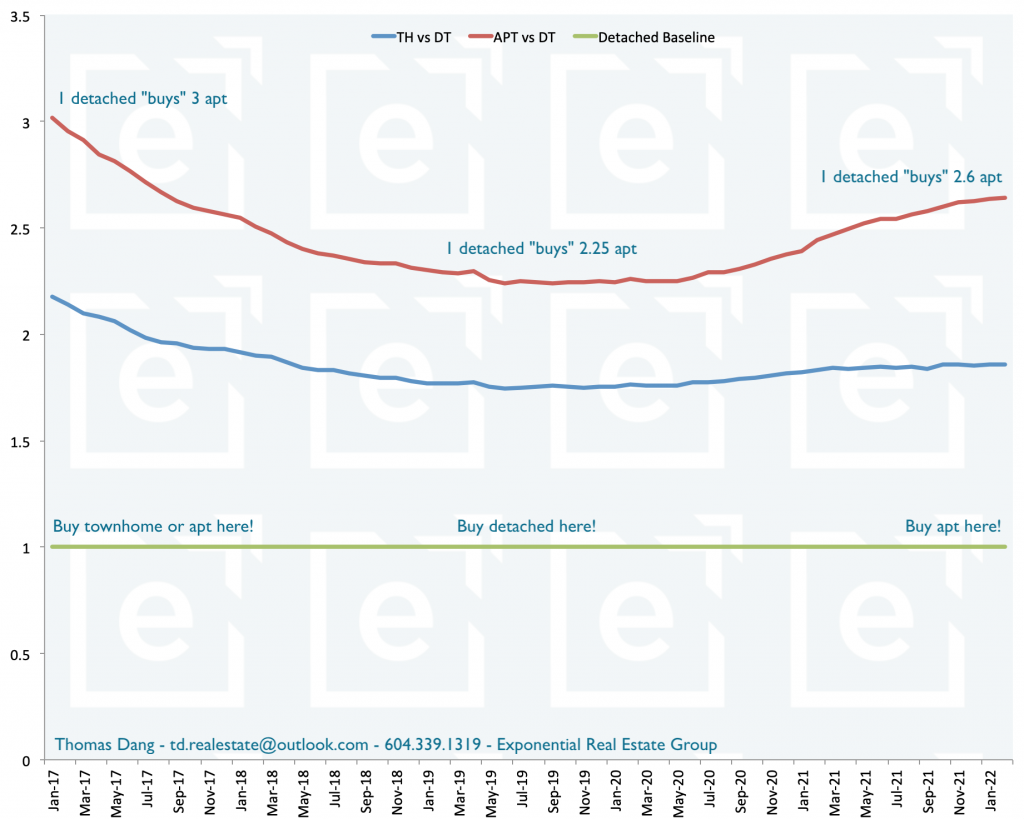

But is this voice grounded in data? Let’s consider this chart below.

This graphics shows the relative price of an average apartment and a townhome at a given moment in time in comparison to an average detached for the entire Metro Vancouver region. It is clear that over time, the price of condo vs townhomes vs detached do not move in lockstep.

In Jan 2017, you can buy 3 condos for the price of 1 detached home. That meant detached was expensive relative to condos.

From a pure capital gain perspective, buying detached would not have been the best move here.

Toward the end of 2019 and the start of 2020, you can buy only 2.25 condos for 1 detached home. That meant at this point, condos has gained value relative to detached. Detached is thus a good buy here.

How about right now, Feb 2022? A detached “buys” 2.6 apartment. Condos has once again became relatively “cheaper.”

Townhome, interestingly, became more expensive relative to detached toward the end of 2019, but has not become relatively cheaper again toward the present yet. The relative strength of townhome is partly due to the fact that there have been fewer townhome projects being built in the region instead of apartments.

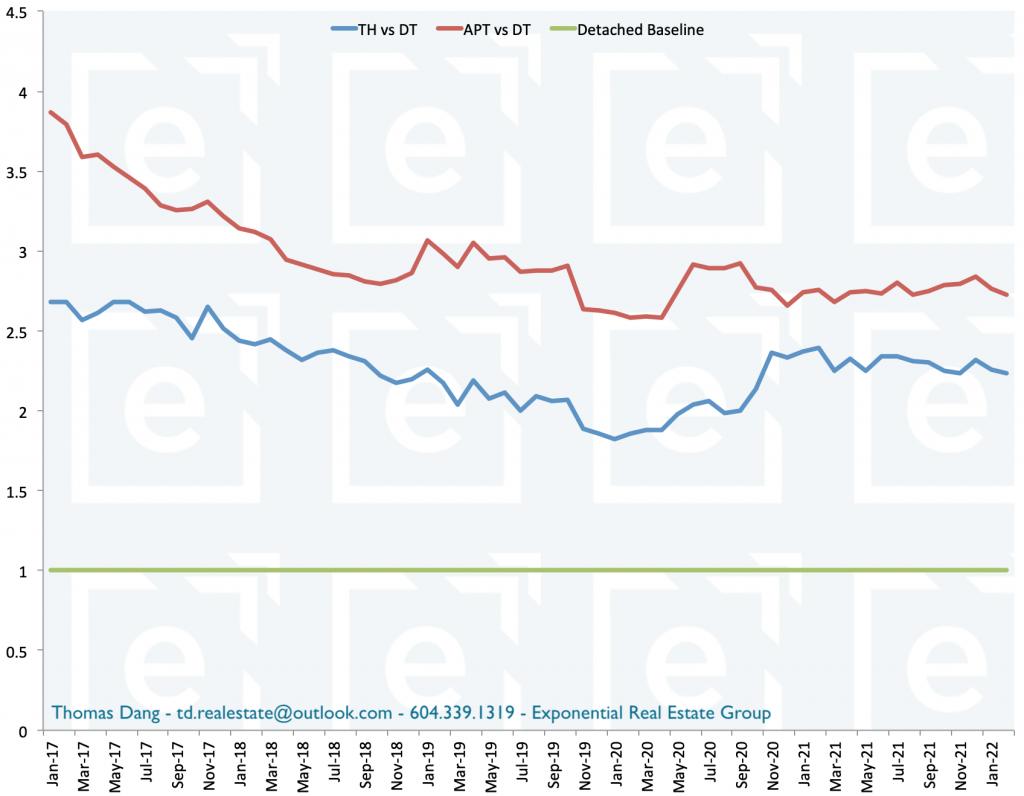

But Thomas! Does this ebb and flow of the different property types apply to specific neighborhood? Or is this just a statistical coincidence when grouping all the very different areas in Metro Vancouver together?

Let’s focus on Metrotown, Burnaby. I picked this neighborhood to highlight as it recently shows an interesting pattern.

From Jan 2017 to Feb 2022, you can see that the average apartment has increased in relative value versus detached, and this strength did not seem to let up. 5 years ago, you would be able to buy almost 4 apartments with an average detached. From the start of 20 onward, the “trade” stayed consistently below 3 times.

Townhouse saw strength relatively to detached toward the start of 2020, then has been slowly receding toward the present.

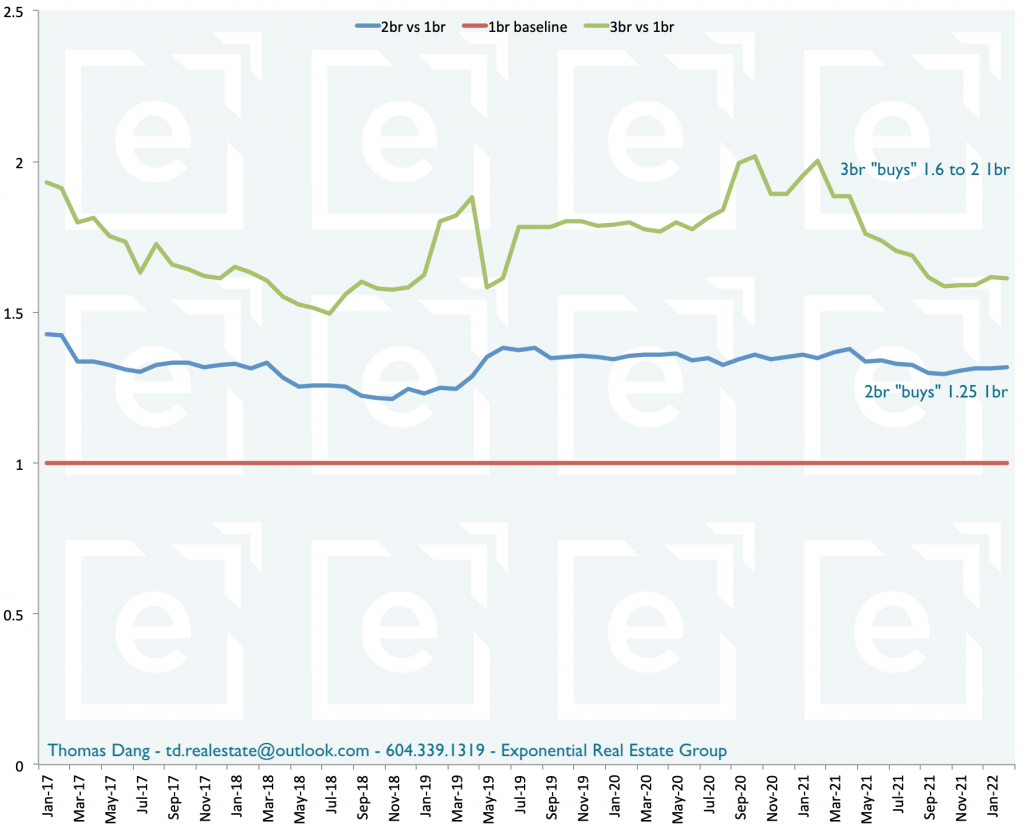

Instead of looking at relative strength between property types, let’s focus on just apartments. From the chart below, you will see that the relative value of a 1 bedroom apartment ebbs and flows over time compared to a 2 br and a 3 br as well.

What is the practical implication of this relationship?

For example: The current “trade” for a 2 br is 1.25 of a 1br. Meanwhile, year end 2021 rental stats from the CMHC shows that an average 1br in South East Burnaby rents for 1175/m, while a 2br rents for 1550/m, and a 3br rents for 1800/m.

So while a 2br is only 25% more expensive than a 1br, it rents for 1550/1175 => 32% higher. Meanwhile, a 3br is 60% more expensive than a 1br, but only rents for 53% more.

The best relative value in Metrotown within the apartment category is a 2 bedroom.

Curious to know what is the best investment for YOUR neighborhood?

PM us or contact me at td.realestate@outlook.com or 604.339.1319.

One thing for certain, the capital gain potential of any asset type depends on many factor, and varies over time as well as between different areas, neighborhood, and specific properties. “Detached or nothing” is an oversimplification of the beautiful complexity of real estate investment.

Our team of professionals will help you make sense of the investment concerns, so that you can focus on the requirements that truly matter, your quality of life and enjoyment of a new home for years to come.